General Banking Terms & Conditions

Wanfuteng Bank asks that you read these Terms & Conditions carefully as it contains important information.

This agreement is between us, Wanfuteng Bank Limited, (‘Wanfuteng Bank’) a financial institution registered in Vanuatu, CN 300929, and you, the person or persons we’ve opened account(s) for. Your agreement with us consists of these Terms and Conditions together with additional terms that apply to any products or services that we provide to you now or in future. In these Terms & Conditions, ‘we’, ‘us’, ‘our’ and ‘WBL’ refers to Wanfuteng Bank Limited (CN 300929).

Additional terms include:

-

our Features, Fees and Charges Schedule; and

-

our account opening application and any further terms we provide to you (together referred to as “The Terms”).

If there is a conflict between these Terms and Conditions and any additional terms, the additional terms will apply. These Terms are available on our website: www.wanfutengbank.com or you can call at +678 28 880 or email us at feedback@wanfutengbank.com to ask for a copy.

1. Privacy

Your privacy is important to Wanfuteng Bank.

You explicitly consent to us accessing, processing, and retaining any information you provide to us, for the purposes of providing payment services to you and complying with the legal and contractual obligations, as detailed in our Data Privacy Policy, available at our website www.wanfutengbank.com. This doesn’t affect any rights and obligations you or we have under data protection legislation.

You may withdraw this consent by closing your account. If you do this, we’ll stop using your data for this purpose, but may continue to process your data for other purposes.

2. Eligibility for Wanfuteng Bank Account

You must apply to open a Wanfuteng Bank account. Your application is always subject to acceptance by us. We may refuse an application without giving a reason.

A Wanfuteng Bank account may only be opened in your legal name. If you have changed your name due to marriage or you are known under a different name to the one shown on your current identity documents, you may be required to provide additional documents that can prove your identity.

A Wanfuteng Bank account is not available to you if the laws and regulations that apply to you or the country in which you live do not allow it. The products and services we offer change and we may not always be able to offer them to you, now or in future. If your citizenship or residency change, you must inform us within 30 days. We are not responsible to you if we cannot continue to offer or provide Wanfuteng Bank products or services to you for any reason.

To open and maintain Wanfuteng Bank accounts, you must meet our eligibility criteria at all times. Our eligibility criteria may change from time to time.

3. Opening Wanfuteng Bank Account

Wanfuteng Bank products and services are provided from Vanuatu. We may provide services from other locations around the world using third-party service providers.

Wanfuteng Bank provides banking services at its main office in Port Vila. We may change our banking hours, practices and procedures from time to time. We will usually provide you with prior notification of these changes but may not always be able to do so. Any reference in these Terms and Conditions to a time is a reference to time in Vanuatu. We offer money transmission accounts and savings accounts in multiple currencies. These currencies may change and may not always be offered or available. If you don’t add any money to your account within a reasonable period of time after the account is opened, we may close it immediately and without notice to you.

INFORMATION WE NEED FROM YOU AND WHEN WE CAN DISCLOSE INFORMATION ABOUT YOU

If we ask, you must provide us with information about you, your wealth, the source of your wealth during your lifetime and the purpose of any transactions you undertake or wish to undertake.

If we make a reasonable request for information, you must give it to us as soon as possible. If you don’t, or we suspect fraudulent or criminal activity of any kind:

-

you might not be able to keep banking with us;

-

we might try to get it from somewhere else; or

-

we could block or close your accounts.

You must make sure the information you give us is accurate and up to date and tell us if anything changes within 30 days.

We may use your information, and we will also give it to others if required by law or if we need to disclose it to protect our own interests (e.g. in legal proceedings) or where we have your agreement to disclose it.

If you are a tax resident outside of Vanuatu, then regulations on international tax transparency may require us to report certain information about you and your accounts to the Vanuatu Competent Authority. Under international agreements to exchange tax and account information, the Vanuatu Competent Authority may transfer this information to the tax authorities of other jurisdictions.

4. Tax Compliance

Your tax responsibilities depend on where you live, where you do business and other factors. It’s up to you to make sure you meet these obligations and you only are responsible to seek tax or/and legal advice to a third part. Wanfuteng Bank will not provide you with tax or legal advice as per your Tax Compliance and Wanfuteng Bank is not liable to you or any other for that matter. If you think having an account with Wanfuteng Bank might affect your tax obligations, you should speak to an independent advisor. This also applies to connected persons. A connected person is a person or entity you have a connection with that’s relevant to your relationship with us. For example, anyone you send a payment to, anyone who operates an account for you, anyone entitled to money in your accounts, etc.

5. Communication with You

You must provide us with your full current principal residential address, any correspondence address and your email address and telephone numbers.

Unless you live in an area where there is no street address, we will not accept a post office box as your residential address. You must ensure that the contact details you provide are accurate and you have to notify us of any changes within 30 days. Our communications with you may contain confidential and personal information. If anyone else has access to your email, mobile phone or other devices, they may see these confidential communications. You allow us to contact you for service or operational reasons using any contact details we hold for you, including any telephone number, email address, Secure Message in Online Banking or any residential address where you have provided a correspondence address. We may record telephone numbers you call us from and may use them if we need to contact you. For security and operational reasons, we may use specialist courier services to send some documents to you if you live in certain countries or locations. You agree that we may charge you reasonable courier charges.

Before we do certain things (e.g. provide information about your account, or make payments) we need to check we’re dealing with you and that you’ve authorized the action we’re taking. We may not be able to assist you if we are unable to identify you or we may ask you to provide further evidence of your identity. When you use your security details to operate Online or Mobile Banking or you use a payment device (or another service we provide for accessing your accounts), we’ll assume we are dealing with you and you have authorized the instruction we receive. We are not liable should it not be you. We may change the ways we check your identity.

6. Statements & Other Information We’ll Give You

When we make or receive a payment, take charges or apply interest we’ll give you details by updating the information we provide through Internet Banking or Mobile Banking.

Your statements will be available through Internet Banking Service, unless you’ve specifically asked us for paper statements.

Should you opt to receive paper statements, you will need to collect these at the branch, or have them posted to your nominated address. Any fees for issuing paper statements or issuing copies of statements are given in our Features, Fees and Charges Schedule.

To help us and you prevent fraud, you must tell us as soon as possible if you think there are any unusual or incorrect transactions on your accounts. If you don’t do so, you may not have a right to a refund. It is important to view your transactions regularly and keep track of your balance, including any overdraft usage.

7. Keeping Up Security

We’ll make reasonable efforts to prevent unauthorized access to your account. You must also act reasonably to prevent misuse of your account by keeping your payment devices, security devices, card readers, personal information number and security codes (collectively your “Security Details”) safe. To prevent misuse of your accounts you must:

-

keep your card and other Security Details safe and never write down or record your Security Details in a way that could be understood by someone else;

-

keep your Security Details unique to your accounts with us and choose Security Details that are not easy to guess;

-

take care to ensure that no one hears or sees your Security Details when you use them;

-

not disclose the Security Details when using the cards to make payments;

-

not disclose your Security Details for mail order payments or when paying for goods and services over the telephone or through the internet;

-

not allow anyone else to have or use your card, or any of your Security Details and not disclose them to anyone, including the police and us, except your card number and other card details when using your card to make payments, and your Security Details when using the Mobile Banking Service or Online Banking Service (but even then, do not disclose in full);

-

keep card receipts and other information about your account containing personal details (such as statements) safe and dispose of them safely. People who commit fraud use many methods, such as searching in rubbish to obtain this type of information. You should take simple precautions, such as shredding paper containing this information;

-

change your Security Details immediately and tell us as soon as possible if you know or suspect that someone else knows any of those details, or if we ask you to;

-

contact us immediately if any card or your Security Details are lost or stolen, or you suspect someone has tried to use them or we ask you to contact us about a suspected fraud;

-

sign each card as soon as you receive it if it bears a signature strip and not tamper with the card;

-

comply with the instructions, recommendations and advice we issue regarding keeping your card and Security Details safe;

-

when you call us, we will confirm your identity using our current security procedures;

-

when we call you, we will never ask for details of your Security Details to identify you as our customer. We will ask you questions based on information known to us about you and the transactions on your account;

We recommend that you use either a landline or a digital mobile telephone. We are not responsible for the security of your account if anyone else overhears you speaking to us on the telephone. -

keep your internet enabled device secure by using and staying up to date with security software containing anti- virus, anti- spyware and firewall technology, and software and operating system patches;

-

keep any security devices and Security Details secret – we will never ask you for your online banking security information in full;

-

if accessing via an internet browser, always access the Online Banking Service by typing in our URL, never go to the Online Banking site from a link in an email and then enter personal details;

-

never access Internet Banking Service from any internet enabled device connected to a local area network (LAN) (this is usually the case for computers you use at work) or any public internet access device or access point (e.g. at an internet cafe) without first making sure that no one else will be able to observe or copy your access, or get access to the Online Banking Service, by pretending to be you;

-

never record your Security Details on any software which retains them automatically (e.g. any computer screen prompts or ‘save password’ feature or the line on your internet browser) unless retaining them is a specific function of a banking service provided by us;

-

if you have logged on to the Online Banking Service, do not leave the device from which you have accessed it or let anyone else use that device until you have logged off; and

-

follow all security measures recommended by the manufacturer of the device you use to access the Online Banking Service, e.g. the use of personal identification numbers for smartphones and/or tablets with internet access.

We may ask that you co-operate with us, or any governmental authority, in relation to any investigation into the actual or suspected misuse of your accounts, including reporting any unauthorized transactions to the police promptly if we request it.

We may also disclose information about you or your account to the police or other third parties if we think it will help prevent or detect financial crime or recover losses.

8. Joint Accounts

We will only accept a mandate from you to operate your Wanfuteng Bank accounts if it permits each person to operate them at all times. Each person to a joint account can operate the account and we won’t check with any other before carrying out any instruction from one of you.

All joint account holders will be jointly and severally responsible for repaying any money you owe us, including any debit balances in your transactional accounts.

We can ask for confirmation from all the account holders before we change how you use the account or before we close the account. You agree we can deposit money we receive that is just for you into your joint account.

If any one account holder tells us there’s a dispute, we may continue to pay all existing standing orders and Direct Debits, but all parties must jointly authorize all other payments. If there’s no money in an account over which you notify us of a dispute, any one of you can ask us to close it.

If everyone agrees, you may ask us to add a person to an account. Everyone added to an account may see all the account information, including historical information from before the account was changed.

If we’ve been given proper and satisfactory official evidence that one of you has died, we’ll transfer a joint account into the names of the remaining account holders.

9. Other People Who May Operate Your Account

You may allow another person to operate your account if you give us a signed third-party mandate or Power of Attorney which operates under Vanuatu law. If you’re not able to operate your account for any reason (such as mental incapacity), another person may be appointed to act for you. That person will need to provide us with satisfactory legal documents that apply under Vanuatu law upon which we will allow that person to use your account and they and you will be responsible for everything they do. We may stop a person using your accounts if we suspect they are misusing your accounts or breaking a law or other requirement.

10. Trust accounts

You must tell us if you’re opening an account as a trustee of a trust, even if the trust doesn’t have a trust deed. We have certain rights if you haven’t told us you are acting as a trustee of a trust:

-

We can assume you’re acting on your own behalf under any agreements with us, and your accounts are being used for your benefit only;

-

We’re not responsible to you, any other trustees, or any beneficiaries of the trust, for any actions you take, or don’t take, when using your account.

You must tell us immediately if any trustees change or if your trust deed changes. If any trustees change, we can ask all trustees to sign a new master account mandate. We can also ask you for copies of the documents changing the trustees or the trust deed. If you’re a solicitor, accountant, or other trustee we’ve agreed is an independent trustee, we’ll restrict your responsibility to the property of the trust when we recover any amounts the trust owes us. We won’t recover money from you personally if the property of the trust isn’t enough to repay us any money owing. However, we can recover amounts owing from you personally if we incur losses or costs because you acted deliberately, or dishonestly, in breach of your duties as trustee.

11. Partnership Accounts

If your account is for a partnership, you must tell us in writing if there are any changes to the partnership after your account is opened.

You need our written agreement to release a partner from any responsibility for amounts the partnership owes us. If the partners change, we can ask all partners to sign a new master account mandate. We can also ask you to give us copies of the documents changing the partnership. Each partner is responsible for amounts owed to us on the partnership’s account, by themselves and with the other partners

12. Payments

This section is about payments in and out of your Wanfuteng Bank accounts. Some accounts have restricted or no external payment capability. Please check before you wish to make a payment that your account permits it. Charges apply to using certain payment services - please refer to the Features, Fees and Charges Schedule.

We don’t accept or make payments in all currencies, so please ask us.

All payments and decisions about payments are made on working days and how we manage payments can depend on where and how the payment is made and what currency it is in. As we use multiple international payment systems and schemes, we are not able to guarantee payments will be received by intended beneficiaries at any particular times and cannot be liable for delays outside our control.

Payments made on your Wanfuteng Bank account will be processed on the same working day, provided that it is made before:

-

1:00 PM for local payments

-

12:00 PM for international payments

Any transaction made after these cut-off times may be processed on the following working day. Cheque deposits at Wanfuteng Bank ATMs may take longer to clear.

If you make a deposit at another financial institution, there may be a delay of several days before it shows on your account. You will be responsible for all costs, charges, fees and taxes we or you are liable to pay for making or receiving a payment. You agree we may deduct these from your accounts.

13. Cheques

You may only issue cheques if we allow you. You must only use cheque books issued by us. To prevent fraud, you must take all reasonable precautions to prevent any cheque you issue being altered or used to facilitate fraud.

To help stop someone changing cheques you’ve written or other cheque fraud:

-

use pen when writing cheques;

-

fill up the space when writing the amount — use a line to fill in any blank spaces after words;

-

date the cheque;

-

don’t sign cheques made out to cash, until you’re ready to cash them; and

-

never pre-sign blank cheques.

If a cheque book is lost or stolen, you must tell us immediately. You must not issue future dated, undated or incomplete cheques. You agree that we may choose not to pay any cheque you issue that is dated more than 6 months previously. It may not be possible to stop a cheque you issue and you should contact us to request a stop without delay. Cheque books remain our property at all times and must be returned upon our request.

Cheque books will only be issued in local currency – Vatu. Vatu cheques made payable to you may be deposited at a branch, ATM, or sent by post to us together with details of your name, account number, address and your signature. We will only be responsible for cheques once we have received them.

We reserve the right to refuse foreign cash or travelers’ cheques or non-Vatu cheques. You must get our prior approval before sending us non-Vatu cheques. Without prior approval we may return the cheque to you. Clearing of cheques are subject to the rules and clearing processes of any cheque clearing systems used by us. It may not be possible to collect all cheques in all currencies and some currency cheques may take longer than others or may be subject to restrictions such as exchange controls or delays. We will not be liable for any costs, loss, damage or delay unless it is as a result of our negligence or mistake.

You must sign and print your name on the back of any non-Vatu cheques you wish pay into your account. Your printed name should be the same as your name on the front of the cheque.

If you send us a cheque in a currency for which you do not hold an account, we will treat this as your instruction to collect the proceeds and then convert them into the currency of your account at our prevailing standard exchange rate.

Should your cheque be dishonoured by Wanfuteng Bank due to insufficient funds in your account, a fee will be payable as per the Features, Fees & Charges Schedule.

14. Electronic Payments

All electronic payments to and from your Wanfuteng Bank accounts are made in Vanuatu. The payment systems we use may not be the same as those in other countries and some payment schemes may not apply in Vanuatu. We may return payments with incomplete, conflicting or incorrect details. If we receive a payment in a different currency to the currency of your account, we will convert the payment into the currency of your account at our prevailing standard exchange rate.

15. Payments into Your Account By Mistake or Fraud

If a payment is fraudulently or mistakenly paid into your account, it may later be recovered. We’ll take back any money we pay into your account if it’s our mistake. This may happen after the money is paid away. If we’re told that a payment wasn’t meant for you (e.g. if the payer used the wrong account number), we’ll contact you. If you tell us the payment wasn’t a mistake, we may ask to share all relevant information with the paying bank, including your name and address and transaction information, so that the payer can contact you directly.

16. What Happens If there are Incorrect or Unauthorised Payments on Your Account?

If you give someone your payment device or security details and they use them to make a payment, we will treat the payment as if you’d authorized it. This is why you must not tell anyone your security details or allow anyone access to your payment device.

What is an incorrect payment?

A payment that has not been sent to the person or account you specified when you instructed us to make the payment.

What is an unauthorized payment?

A payment made from your account which wasn’t authorized by you or someone you’ve authorized to make payments on your account.

What is ‘gross negligence’?

Gross negligence is when you do something with a significant degree of carelessness.

What must you do if you notice an incorrect or unauthorized payment?

You must call us as soon as you can.

Will we always make a refund? No. We won’t make a refund:

-

For an incorrect payment, if we can prove that the payee’s bank received the payment;

-

for an unauthorized payment, if we know you’ve been grossly negligent or we reasonably suspect fraud on your part;

-

for an incorrect or unauthorized payment if you don’t tell us promptly after it was made.

17. Payments from Your Account

You can make the following types of payments from your account:

-

payments using our Internet or Mobile Banking Service;

-

standing orders and Direct Debits (for Vatu bank accounts only);

-

debit card payments and cash withdrawals using certain ATMs (if we have issued you a debit card);

-

cheques (but only if we have provided you with a cheque book).

Large amounts of over the counter, cash withdrawals are subject to availability. Please contact us in advance to request specific denominations.

We’ll make a payment from your account if you instruct us to unless:

-

you don’t have enough money in your account (including any overdraft);

-

you haven’t given us the account or reference details or we know they’re incorrect;

-

you’ve asked us to send the payment in a particular way and the recipient’s bank doesn’t accept them;

-

you’ve not provided any extra identification or information about the payment that we’ve reasonably asked for;

-

the payment exceeds a limit that we tell you when you make the payment,

or we reasonably believe:

-

there has been a breach of security or misuse of your account, security details or a payment device;

-

there has been fraudulent or criminal activity of any kind whether or not linked to your account or your relationship with us and it’s reasonable for us not to make a payment;

-

it would cause us to breach a law, regulation, code, court order or other duty, requirement or obligation or expose us to action or censure from any government, regulator or law enforcement agency; or

-

someone else may have a claim over the money.

If we’re able to make some but not all of the payments, we’ll pay Cheques first and then Direct Debits and Standing Orders and, if there’s more than one, we’ll start with the smallest payment.

You can always call us immediately to find out why we’ve refused a payment and what you need to do to correct any errors that made us refuse it and we’ll tell you unless we’re prevented by law or any regulation or for fraud prevention or security reasons. You can also get transaction information through Internet and Mobile Banking.

You must be careful when making payments to ensure that you use the correct beneficiary details. We are not always able to recover payments made using incorrect beneficiary details. We do not accept liability for any loss if you provide us with incorrect or incomplete beneficiary details.

18. Blocking Payments and Services

We may block any payment device (and your access to related services such as Mobile and Internet Banking Services) if we reasonably believe it’s necessary because of:

-

significantly increased risk that you may be unable to pay any money you owe us on the relevant account;

-

suspected fraudulent or criminal use of the payment device;

-

security concerns (e.g. if we know or suspect your payment device and/or security details have been misused); or

-

our need to comply with legal and regulatory obligations that apply to us or you anywhere in the world.

If we do this, we’ll usually let you know why immediately afterwards, unless we’re prevented by law or any regulation or for security reasons. We’ll unblock the payment device as soon as the reason for blocking it ends.

We may contact you by text message, telephone or by email, even after we have accepted a payment request, for further validation checks. If we are not able to contact you, this may result in a delay in the payment being made or us not making the payment.

19. Charges

You agree to pay the fees and charges that apply to our products and services, details of which are in our Features, Fees and Charges Schedule available online at our website: www.wanfutengbank.com, or available in our branch. We may change our fees and charges and will give you a 30-day notice of any change or a new fee or charge.

20. Interest Rates

Our fixed term deposit interest rates are available online and in our Port Vila branch. Lending interest rates vary accordingly to each customer’s risk profile and lending products provided, and these will be quoted on request based on your specific needs and circumstances,

Interest is calculated on a 360-day basis for USD and EU currencies and on a 365-day basis for VUV (Vatu), AUD, NZD, GBP, JPY, HKD, CNY, CAD, CHF (and other currencies that may be available from time to time). Interest rates are set according to the type of account and the amount deposited.

Credit interest is not payable on all our accounts. Interest is credited to the balance of the account to which it applies. Negative interest may be applied to credit balances for some currencies.

We may change the interest rates applied to credit balances. If we do this, we will update the information on our Internet Banking page or our website.

21. Overdrafts

You may apply for an overdraft on your Wanfuteng Bank account.

If we approve an arranged overdraft, you must make pay monthly interest and repay the overdraft when due as per the letter of offer issued to you confirming your overdraft arrangement.

Unless we have agreed other terms with you in writing, we may, at any time, withdraw your overdraft facility and demand immediate repayment of any money you owe to us. We may also notify you that we have cancelled, reduced or increased your overdraft limit.

Overdraft interest is calculated daily on the outstanding balance of your account. We will charge you overdraft interest as set out in the letter of offer pertinent to your account.

22. Set-Off

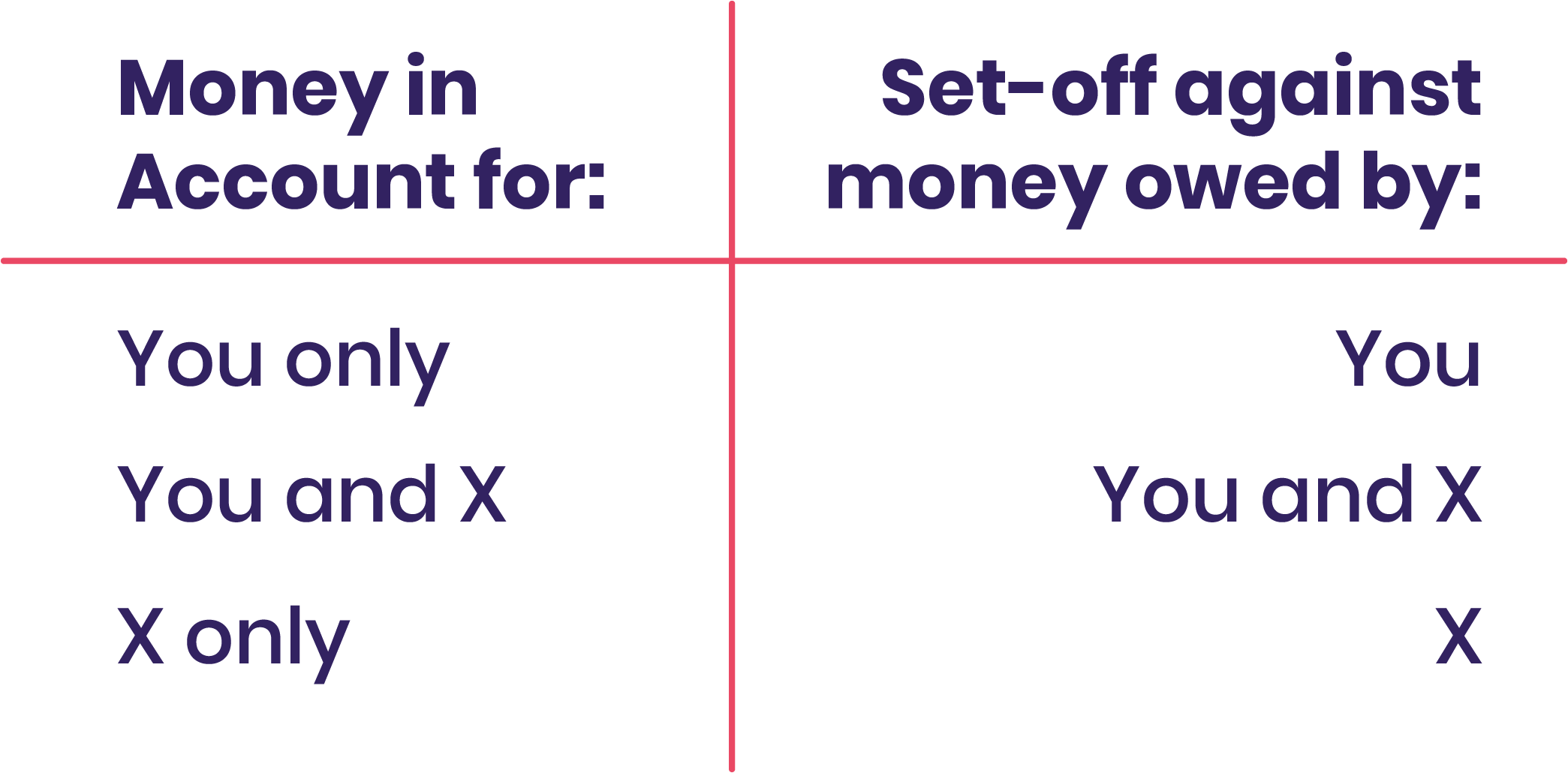

If you have money in one of your accounts, we may choose to set it off against any amount you owe us which is due for payment. Amounts owed include amounts owed under a loan, credit card, mortgage or overdraft. Our set-off right applies to accounts in your name only and to accounts you hold jointly with another person (X) as shown below:

We can use money in your account even if there’s a court decision against you or you’re fined (including interest arising after the date of the final decision or fine), unless we’re prevented by the court or by law. If you have money in a foreign currency, we may convert it to Vatu using our Exchange Rate when we use our set- off right. If we receive a legally valid notice to hold or pay money in your accounts to someone else, we won’t set-off against this money. We will notify you after we have exercised our right of set-off.

23. Inactive Accounts

If there have been no active transactions on your transactional account (e.g. accounts other than your loan accounts and/or fixed term deposit accounts, or similar interest bearing accounts as Wanfuteng Bank may from time to time designate), other than direct debits or standing orders, for more than 12 months we will treat it as an inactive account. An inactive account will not be restricted and may be reactivated if you undertake a transaction. If you don’t undertake any transactions on an inactive account for a further 12 months, the account may become restricted. To protect your money, no payments, including direct debits and standing orders, are permitted on a restricted account until it is reactivated. To reactivate a restricted account, you will need to contact us and may be required to provide additional identification information.

24. How You May Close Your Accounts

You can close your account and end this agreement by telling us. As soon as you do, any account benefits will end. You’ll have to pay all normal fees and charges for using the account. We’ll send you any balance when everything you owe us has been paid.

If you die, we will usually require your executors to obtain a Grant of Probate or similar legal document issued by the relevant authority in Vanuatu before releasing any money.

25. How We May End This Agreement and Close Accounts

We may end the agreement and close your accounts immediately and without notice if you:

-

have seriously or persistently broken this agreement;

-

acted abusively, offensively or violently towards our staff;

-

weren’t (or are no longer) entitled to open or have your account or the service;

-

haven’t provided us with adequate information that we’ve requested or

-

provided us with false information.

We may also end the agreement and close your accounts immediately if it’s reasonable for us to believe that you:

-

have or are using or obtaining or allowing someone else to use an account, service or money illegally or fraudulently;

-

are using an account for a purpose not covered by this agreement;

-

are involved, in any criminal activity whether or not linked to your account or your relationship with us;

-

have placed us in a position where we might break a law, regulation, code, court order or other duty, requirement or obligation or we, may be exposed to action or censure from any government, regulator or law enforcement agency;

-

or your accounts, security details or payment device may have been subject to a breach of security or misuse.

We can also end the agreement and close your accounts, without having to provide any reason, by giving you at least a 30 day notice if:

-

you no longer meet the eligibility criteria for Wanfuteng Bank from time to time;

-

you open an account and do not pay any money in during the first three calendar months;

If you or we close an account or end the agreement, we’ll take any debit card payments that haven’t yet been charged to the account and charges and interest which haven’t yet been applied to your account, before we pay what is left to you. If any transactions occur after your account is closed and you made them at a time the account was open, you agree that you will be indebted to us even after this agreement has terminated and your accounts closed.

If you decide to close your accounts, or if we’ve closed your accounts, for any reason, we may ask you to:

-

Return any EFTPOS cards, Visa Debit cards or credit cards – cut it in half through the magnetic strip first; and

-

Return any cheque or deposit books.

You’ll also need to immediately repay any money you owe us. If any money is left in your account before it is closed, we’ll let you know how we’ll pay this money to you. We can refuse to pay you any amounts if we believe you owe us money now that you must pay to us on a future date

You’re responsible for cancelling payments into and out of your account before it is closed.

26. Changing the Terms

Our agreement has no fixed end date so it’s likely we’ll need to make changes to these Terms in future. As we cannot know precisely why we might need to make changes to the Terms, we may make changes for reasons that aren’t covered here.

We can tell you about changes by giving you notice on our website www.wanfutengbank.com, through our Internet Banking Service, through our Mobile Banking Service or personally.

When we tell you about a change personally, we may do this by post, email, Secure Message, a message on your statement or in another way that will be sent to you individually.

We may make changes to the Terms including changes to any charges in the Features, Fees and Charges Schedule and changes to the basis on which we charge for operating or providing products and services

-

if the change is favourable to you, within 30 days of the change; or

-

if the change is not favourable to you, by giving you reasonable advance personal notice.

27. Your Rights When We Tell You About a Change

If we give advance notice that we’re going to make a change to this agreement and you don’t tell us you want to close your account before that change takes place, or within the next 30 days (if longer), then the change will apply automatically at the end of the notice period. If you tell us that you don’t want to accept the change, you can close your account without charge.

28. Other Important Terms

These Terms and the products and services we offer or provide to you are governed by the laws of Vanuatu. You agree that the courts of Vanuatu shall have jurisdiction to resolve any dispute about these Terms.

A person who is not a party to these Terms will have no rights to enforce them or any part of them.

We won’t be responsible for any losses you may suffer if we can’t perform our obligations under this agreement due to any legal or regulatory requirements anywhere in the world or any abnormal or unforeseeable circumstances which are outside our (or our agents’ or subcontractors’) control and which we couldn’t have avoided despite reasonable efforts such as industrial actions or system failures. We won’t be liable to you for losses you suffer that we could not have anticipated, loss of goodwill, loss of business and loss of any opportunity to you.

If any parts of these Terms are or become unenforceable in any way, this will not affect the validity of the other Terms.

If we relax or do not enforce any of these Terms from time to time this will not prevent us from enforcing them at a later time.

We may transfer all or any of our rights and obligations under this agreement and in relation to your accounts to someone else but we’ll only transfer obligations to someone we reasonably consider capable of performing them and who is authorized or recognized by our regulator as being able to accept deposit. You can’t transfer any of your rights or obligations in relation to this agreement, your account, or your account itself, to any other person.

We may appoint third parties to act as our agent or provide services to us in relation to this agreement and your accounts.

If you use a Wanfuteng Bank product or service in a foreign country, this may be treated by foreign tax authorities as attracting tax liability. Your tax position will depend on your personal circumstances and you should seek further guidance from your tax adviser.

29. Additional Product Terms

Additional terms apply to specific Wanfuteng Bank products.

30. Fixed Term Deposit Account (Fixed Deposit)

Fixed Deposits are available in various currencies from time to time. Not all currencies are available at all times and other currencies may be available upon request. Minimum and maximum deposit amounts may apply. You can only deposit one amount of money into a Fixed Deposit for a fixed term agreed by us.

The interest rate you will receive is fixed for the agreed term. Interest may be positive or negative and will be calculated daily on the cleared balance.

Interest is calculated daily and can be paid either monthly, quarterly, yearly, or at maturity (if the term is 12 months or less). If the term you select is longer than 12 months, interest will be paid at least annually.

Unless you advise us not to, we will automatically renew your Fixed Deposit for the same term (or one as similar as possible) as that which expired at the prevailing rate of interest we offer for that term.

To prevent automatic renewal, you need to contact us 3 working days before maturity for a Vatu Fixed Deposit and 3 working days before maturity for foreign currency Fixed Deposit.

When a Fixed Deposit expires or you close it, we will pay your current balance into your nominated Wanfuteng Bank account.

You may ask us to allow you to withdraw a part of or the entire Fixed Deposit before the end of the agreed term.

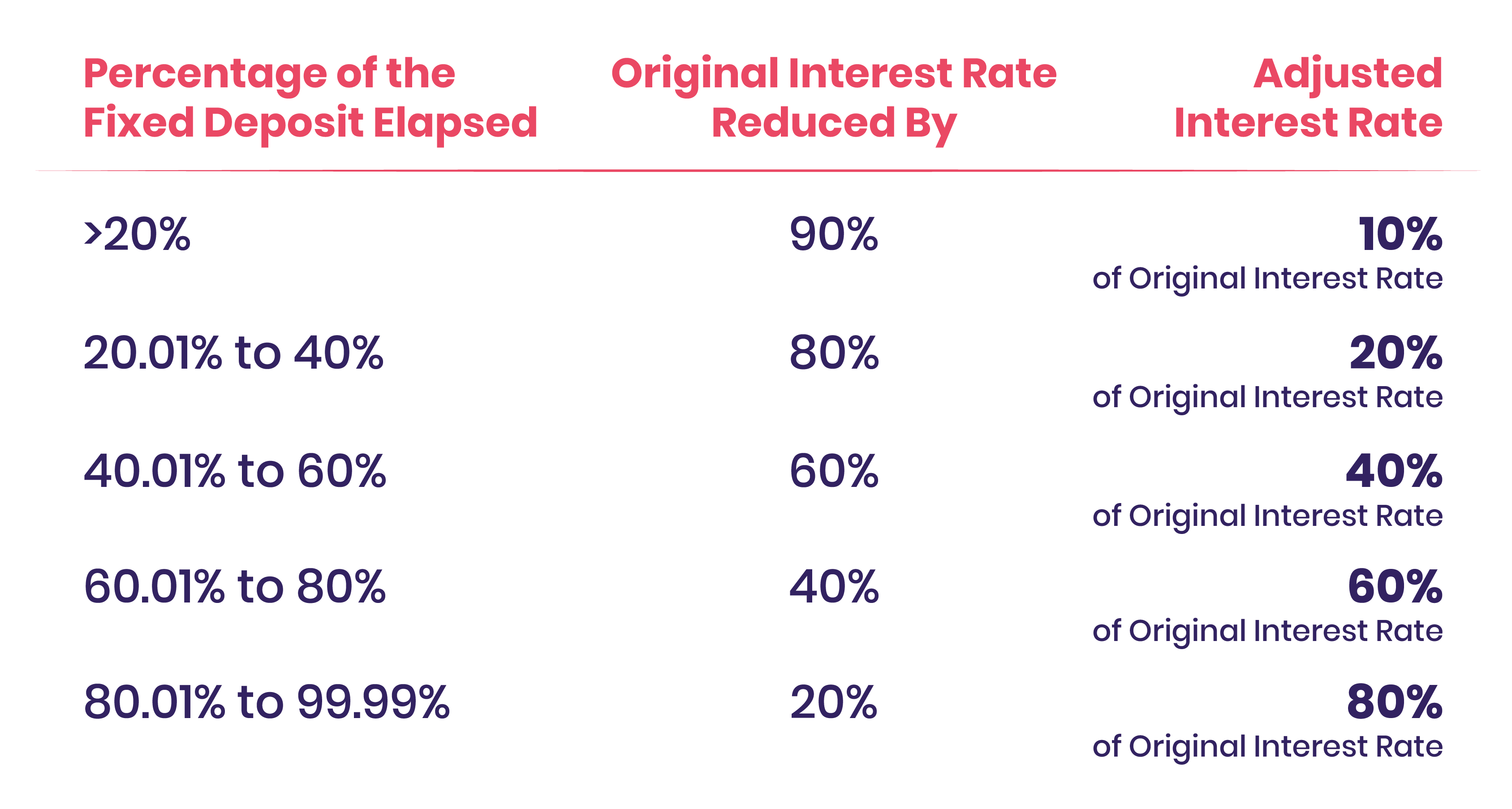

If you ask us to break your Fixed Deposit before its maturity, the early withdrawal fee will be charged as per the Features, Fees & Charges Schedule and we will reduce the interest rate that we pay as follows:

For partial withdrawals, the interest rate applicable to the residual funds on Term Deposit will also be reduced as per the above.

31. Foreign Currency Account

Subject to availability, Wanfuteng Bank may open a Foreign Currency Account for you.

If you hold a foreign currency account with us (which includes foreign currency term deposits), we’ll use the same currency as the account to both:

-

pay any interest we’ve promised to pay you on money in that account; and

-

charge fees on that account.

Deposits into a Foreign Currency Account from either another Wanfuteng Bank account or an account at another bank, shall be by way of inward electronic payment only and no cheque deposits are permitted. Cash transactions are allowed only when allowed by Wanfuteng Bank Withdrawals from your Foreign Currency Account shall be by way of outward electronic payment only and no cash withdrawals are permitted, unless specifically approved by Wanfuteng Bank.

Wanfuteng Bank and other banks may restrict amounts they will send or receive and it is your responsibility to check if this will affect any money you wish to send or receive.

We may reject or refuse any or part of any inward payment or outward payment, or reverse any or part of any inward payment, outward payment or transaction if:

-

we are of the view that such inward payment, outward payment or transaction is in violation of any applicable rules or these Terms; or

-

a correspondent bank or the beneficiary bank should at any time reject or return such outward payment, on any ground (whether or not disputed).

You will be responsible for payment of all costs, expenses, fees and taxes in relation to holding or transacting. We shall not be liable to you for any losses, including exchange rate losses, damages arising from you holding or transacting.

32. Foreign Exchange Transactions

You should be aware of the potential risks of banking in a currency that is not your usual currency.

Remember that, as exchange rates change, the Vatu value of money you hold in foreign currency accounts will also change. The Vatu value of payments into and out of that account will change too. You may suffer a loss as a result of those changes – and if you do, we’re not responsible to you in any way for that loss. For example, if you’ve invested your local currency in a foreign currency term deposit, and the value of that currency falls during the term, you may receive less money back in local currency than the amount you originally invested.

Please also remember that past performance of a currency is not necessarily an indication of its future performance.

For telegraphic transfer transactions involving foreign exchange, please refer to our Telegraphic Transfer Terms & Conditions on our website.

33. Our Details

Wanfuteng Bank Limited is a private company, incorporated and registered in Vanuatu, company number 300929, with limited liability, and is licensed and regulated by the Reserved Bank of Vanuatu as a domestic bank in Vanuatu.

Our registered office is: Churchill House, Kumul Highway, P.O. Box 65 Port-Vila, Vanuatu.

Please note that as our services are provided from Vanuatu, the rules and regulations which govern our services are those of Vanuatu, and any disputes are subject to jurisdiction of Vanuatu courts.

As of the date of effectiveness 02 April 2020, unless otherwise notified by us, the Terms will supersede all previous terms (if any).

Version 02 April 2020